Introducing the latest myCWT product and service enhancements

Building on our digital, omnichannel myCWT platform, our new products and services will simplify travel management for you and your employees – anytime, anywhere, anyhow.

Note: Featured services may not be available in your country at this time. Please reach out to your CWT representative for more details.

Hear from Chief Product Officer, Erica Antony as she shares the key product highlights of 2024, along with the key areas driving innovation.

-

2040: Baseline, Boom or Bust

As we enter an era of rapid transformation and unprecedented challenges, it is essential for travel managers, meeting & event planners, and corporate decision-makers to look ahead and frame our current strategic thinking with a clear vision of the future. Business travel and meetings and events (M&E) are poised for significant change over the next decade and a half, driven by a complex interplay of sustainability goals, technological advancements, evolving work models, and geopolitical dynamics.

In this paper to mark the 10th anniversary of our Global Business Travel Forecast, we explore, for the first time, a long-term vision of the future and potential trajectories through three distinct scenarios, each offering insights into how these forces should affect policy-making, budgeting and priorities. By examining these scenarios, we can better understand the diverse possibilities that lie ahead and the strategic imperatives required to thrive in each potential future.

Based on trajectory data analysis and interviews with industry leaders, behaviorists and climate tech founders, this forward-looking approach enables us to anticipate changes, strengthen our strategies, and make informed decisions that align long-term objectives. It is through this lens of foresight and adaptability that we can build resilience, seize opportunities, and navigate the complexities of the future.

We invite you to reflect on the insights presented, and consider how your organization can prepare for the opportunities and challenges that lie ahead. Together we can ensure that travel and meetings remain catalysts for growth, scalability and sustainable practices.

- Scenario development is both an art and a science

- Megatrends Shaping the Future of Business Travel, Meetings and Events

- Sustainability goals the new crux of corporate policy

- Technology Revolutionizes Travel Management

- Modern work models spark new travel patterns

- Changing demographics open doors to new opportunities

- Three Scenarios: Base case, boom and bust

- Future-proofing strategies

-

CWT GBTA Global business travel forecast 2025

When it comes to pricing, global business travel has finally reached an enduring, higher baseline. Prices will continue to rise in 2025, but only moderately, so expect a period of normalized growth.

However, this pricing environment, one of marginal gains and price regularity, is fragile. Global leisure travel has now realized a lot of its pent-up demand, while corporate travel has been resurgent, with 2024 edging at preCovid levels.

There are many factors at play, whether its volatile oil prices, labor costs and constraints, inflationary pressures, and geopolitical factors. As this elevated baseline edges upwards, albeit marginally, travel budgets will come under increased scrutiny, especially as travel patterns and attitudes change.

It’s why business travel can’t be viewed in a silo, and the true value to an organization must be fully realized. This forecast can help with those calculations.

-

Capitalize on emerging technologies in corporate travel

Technological advancements are accelerating at an unprecedented pace. How will emerging innovations like Generative AI, blockchain, and self-sovereign identity (SSI) transform corporate travel?

BTN and CWT probed global CEOs, travel managers, industry consultants and tech experts on the promises, questions, and expectations these innovations raise and how they are set to reshape traveler experience, cost control and service delivery in corporate travel and events.

Download and discover

- The technologies that will have the greatest impact on corporate travel in the next 2-5 years

- How these emerging technologies are poised to control costs, enhance service and security, and boost efficiency

- The critical challenges, opportunities, risks and roadblocks each innovation raises

- What travel managers, buyers and experts anticipate from these innovations

-

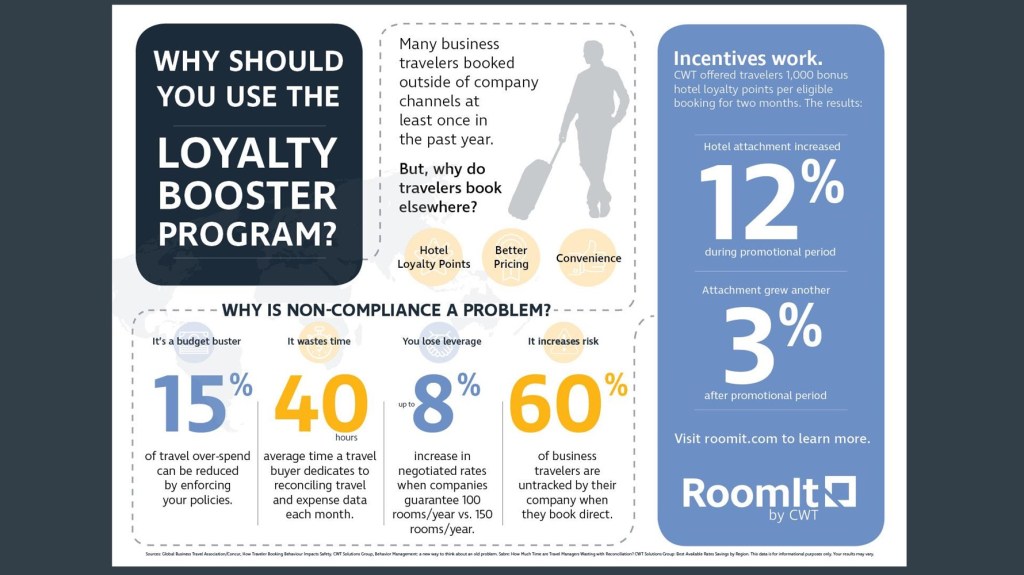

RoomIt by CWT announces new loyalty booster program

RoomIt by CWT, the hotel distribution division of Carlson Wagonlit Travel, the leading global travel management company, today announces the RoomIt Loyalty Booster program. Available free to all RoomIt customers, the program rewards travelers with additional points and miles, while also increasing hotel attachment rates and compliance with their company’s travel policy.

“Instead of penalizing travelers for being non-compliant, we are taking a different approach that is more proactive and much more powerful,” said David Falter, president, RoomIt by CWT. “We have run several campaigns and the success rates have been very good and our clients are extremely happy with the higher compliance rates.”

The program allows travel managers to partner with CWT to run promotional campaigns where travelers are incentivized with either points or miles for booking within their corporate travel program. In testing mode with several clients, the RoomIt Loyalty Booster program delivered a 12 percent higher compliance rate during campaigns (typically 60-to-90 days in length). Additionally, the program often achieved continued compliance with compliant bookings increasing of three percent after campaigns concluded.

Travelers

Travelers want and expect loyalty benefits when they travel and are often enticed to go outside their corporate travel policy to get them. With Loyalty Booster, travelers will enjoy access to additional points or miles that are carefully targeted for their needs within CWT channels. Additionally, all the offers presented will be in line with corporate travel policies, so travelers will be able to get loyalty benefits without worry.

Travel Managers

By motivating travelers to book within the corporate travel framework, travel program managers will increase corporate travel policy compliance within their negotiated travel parameters at no additional cost. This increased compliance rate improves reporting and tracking measures for travel managers.

Suppliers

Loyalty Booster will increase supplier volume by driving traveler behavior using the hotels’ and airlines’ loyalty program currencies. The program incentivizes travelers to use the partners’ services by providing mutually beneficial loyalty rewards when they book through RoomIt.

“Business travelers want to feel empowered when they are booking their travel,” added Falter. “We are giving the ability to feel like they are getting something out of the experience other than just having to travel for work. They now see an opportunity where they can get to their next vacation by accumulating points much faster than before.”

About RoomIt by CWT

RoomIt by CWT is a division of Carlson Wagonlit Travel, a long-standing leader in business travel. RoomIt provides travelers with the rooms, rates, amenities, and loyalty programs they want; while helping organizations control their budget and improve travel oversight.

About Carlson Wagonlit Travel

Companies and governments rely on us to keep their people connected. We provide their travelers with a consumer-grade travel experience, combining innovative technology with our vast experience. Every day we look after enough travelers to fill almost 200 Boeing 747s and around 100,000 hotel rooms, and handle 95 corporate events. We have more than 18,000 people in nearly 150 countries, and in 2016 posted a total transaction volume of US$ 23 billion.

-

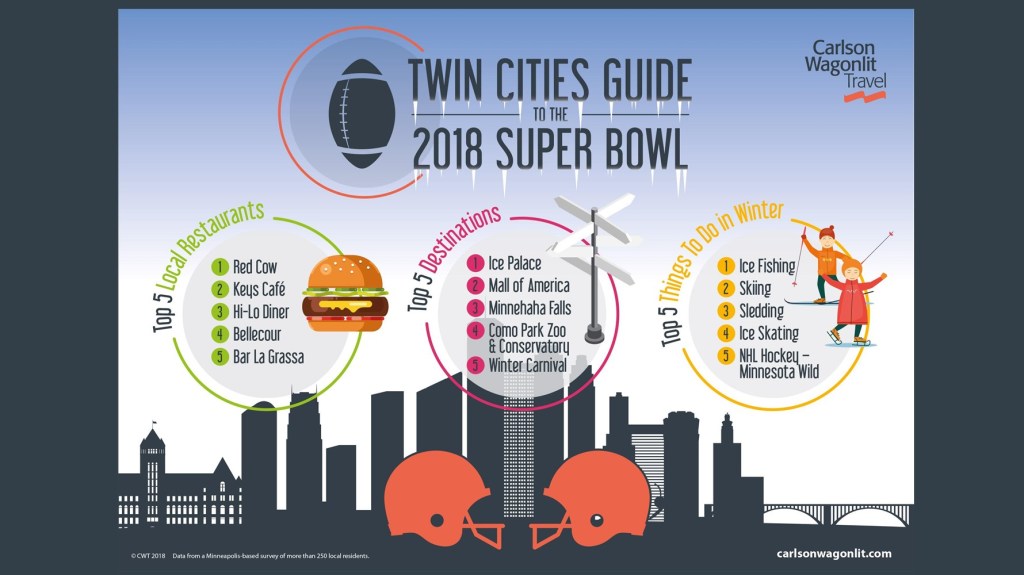

Red Cow, Fishing and an Ice Palace: Minnesotans’ advice for Super Bowl attendees on local favorites

Carlson Wagonlit Travel recently polled 250 Minnesotans for their recommendations on local restaurants, attractions and activities for visitors coming to Minnesota for Super Bowl LII.

The online research, conducted between Christmas and New Year’s Day, found a sense of dawning excitement about the Super Bowl and active engagement, with plenty of suggestions to keep visitors busy and full on their trip to Minnesota. Some suggestions were obvious, such as The Mall of America, as was ice skating, which should be expected in the self-proclaimed State of Hockey.

“We in the business of travel know that people like to do things that are local,” said Patrick Andersen, Chief Strategy and Commerce Officer, Carlson Wagonlit Travel. “Being winter in Minnesota, everyone is thinking it will be cold and that they might have limited options, but our research shows a warm reception is guaranteed, with a fun list of things that are unique to the area this time of year.”

Food & Drink

While some Minnesotans picked chain restaurants such as Chipotle and Applebee’s, most chose local fare as the places to go. The most popular local Twin Cities choice was the Red Cow, a restaurant and tavern known for its gourmet burgers and beer. Running a close second was Key’s Café, a local diner in the Twin Cities known for its big portions. Rounding out the top five local places to eat according to Minnesotans are: The Hi-Lo Diner, Bellecour (a French bistro and bakery) and Bar La Grassa (Italian flair and wine bar). For a unique experience, you can try eating in a rail car at Mickey’s Diner in St. Paul.

Activities

When it comes to winter activities, there is plenty to do in Minnesota. If you need more sports, locals suggest heading to St. Paul for a Minnesota Wild hockey game (tickets are limited). However, if you’re willing to try walking on water, Minnesotans list the top winter activity as ice fishing. With more than 11,000 lakes, Minnesota has no shortage of opportunities to try fishing during the winter – but dress warm (and maybe try a guide to improve your chances). The second most popular activity according to Minnesotans is skiing. You have your choice of numerous slopes in the area from Buck Hill where Olympic champion Lindsay Vonn learned to race, to the many hills of Afton Alps. Rounding out the top activities included sledding and ice skating.

Destinations

While everyone knows about the Mall of America, it didn’t take the top destination for Minnesotans this winter. That distinction goes to the St. Paul Winer Carnival Ice Palace. At a cost of more than $800,000, the structure will be 70-feet tall and feature six towers. The Ice Palace, which is free to the public, is made from more than 4,000 blocks of ice, each weighing more than 500 pounds. If you don’t mind staying outside, you can hike along the frozen Minnehaha Falls. Or, another popular destination according to Minnesotans is the Como Park Zoo and Conservatory.

About Carlson Wagonlit Travel

Companies and governments rely on us to keep their people connected. We provide their travelers with a consumer-grade travel experience, combining innovative technology with our vast experience. Every day we look after enough travelers to fill almost 200 Boeing 747s and around 100,000 hotel rooms, and handle 95 corporate events. We have more than 18,000 people in nearly 150 countries, and in 2016 posted a total transaction volume of US$ 23 billion.

-

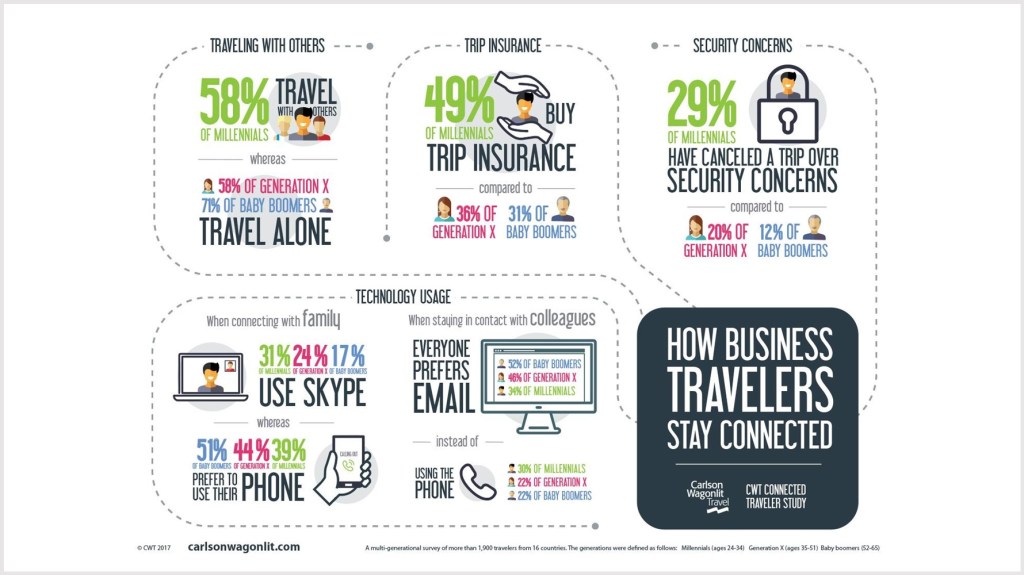

CWT Research: Millennials like to travel in groups – and are the most security-conscious

Millennials are much more sociable than older business travelers, and are also most concerned about their personal safety, according to data released today from the CWT Connected Traveler Study, a multi-generationalsurvey of more than 1,900 travelers from 16 countries.

A full 58% of millennials travel with others, 43% travel with colleagues, and 15% with friends or family. In stark contrast, nearly three-quarters (71%) of baby boomers travel alone. Sometimes, they travel with colleagues (23%) but they rarely bring along friends or family (6%). Generation X travelers are somewhere in the middle, with 58% traveling alone, 31% with a colleague and 11% with friends or family.

“We see a massive generational shift among the habits of younger travelers – the much-vaunted millennials,” said Julian Walker, Carlson Wagonlit Travel’s Head of External Communications.

“Millennials are far more sociable when they travel, love technology and are most concerned about their own personal safety.”

The study found that millennials – defined here as those between the ages of 24 and 34 – are most likely to cancel a trip over security concerns. Nearly one-third (29%) of millennials have done so, compared to 20% of generation X (ages 35-51) and only 12% of baby boomers. Similarly, almost half (49%) of millennials buy trip insurance, compared with only 36% of generation X and 31% of boomers (ages 52-65).

Nearly half of millennials (45%) contact friends or family while traveling more than once per day, compared to 38% of generation X and 29% of baby boomers. Millennials connect more with clients while traveling (55%) than generation X (44%) and boomers (35%) – and with co-workers (41%) versus 28% of generation X and only 19% of boomers.

The use of technology also varies dramatically between generations. When it comes to connecting with family, boomers prefer to use their phone (51%), compared to barely half of generation X (44%) and only 39% of millennials. Conversely, a full 31% of millennials use Skype, compared to 24% of generation X, and only 17% of boomers.

When it comes to staying in contact with colleagues, email is everyone’s preferred method. However, here too, the generations differed markedly. More than half (52%) of boomer’s use email, compared to 46% of generation X and only 34% of millennials. When it comes to using the phone, 30% of millennials and 22% of both boomers and generation X prefer to pick up the phone and call colleagues.

About the survey

The CWT Connected Traveler Study was created by Carlson Wagonlit Travel and conducted through Artemis Strategy Group between 30 March and 24 April, 2017. Survey data was collected from more than 1,900 business travelers between the ages of 25-65 from the Americas (Brazil, Canada, Chile, Mexico and the United States), Europe (France, Germany, Italy, Spain, Sweden and the United Kingdom) and APAC (Australia, China, India, Japan and Singapore). To participate in the study, business travelers were required to have made more than four business trips within the past 12 months.

The generations were defined as follows: millennials (ages 24-34) generation X (ages 35-51) and baby boomers (52-65). The purpose of this study was to understand how business travelers stayed connected to both work and home while on the road.

About Carlson Wagonlit Travel

Companies and governments rely on us to keep their people connected. We provide their travelers with a consumer-grade travel experience, combining innovative technology with our vast experience. Every day we look after enough travelers to fill almost 200 Boeing 747s and around 100,000 hotel rooms, and handle 95 corporate events. We have more than 18,000 people in nearly 150 countries, and in 2016 posted a total transaction volume of US$ 23 billion.

Follow us on Twitter and Linkedin

About Artemis Strategy Group

Artemis Strategy Group is a communications research firm specializing in brand positioning, thought leadership and policy issues.

-

Carlson Wagonlit Travel and Lyft partner to deliver on-demand ground transportation to U.S. business travelers

Carlson Wagonlit Travel (CWT) today announced a new preferred partnership with Lyft, the fastest growing rideshare company in the United States. This agreement delivers on-demand ground transportation travel to CWT’s business travelers within the United States.

“Giving our clients the best end-to-end traveler experience is our unwavering commitment,” said Jim Hartnett, vice president of global supplier management for Carlson Wagonlit Travel. “We are excited about our new Lyft partnership and are focused on delivering best-in-class services for our travelers to reach their destinations in a safe and convenient way.”

CWT is the first major travel management company (TMC) to partner with Lyft. The rideshare company is available to 95 percent of the U.S. population and is in most airport locations.

“We’re thrilled to partner with Carlson Wagonlit Travel, making it easier and faster for their clients to launch and manage seamless travel solutions with Lyft,” said Amit Patel, director of business development for Lyft Business. “At Lyft, we’re committed to improving people’s lives with the world’s best transportation, and working with Carlson Wagonlit Travel to move business travelers in a safe, easy, and affordable way is a natural next step for our work in this space.”

About Carlson Wagonlit Travel

Companies and governments rely on us to keep their people connected. We provide their travelers with a consumer-grade travel experience, combining innovative technology with our vast experience. Every day we look after enough travelers to fill almost 200 Boeing 747s and around 100,000 hotel rooms, and handle 95 corporate events. We have more than 18,000 people in nearly 150 countries, and in 2016 posted a total transaction volume of US$ 23 billion.

Follow us on Twitter and Linkedin

About Lyft

Lyft was founded in June 2012 by Logan Green and John Zimmer to improve people’s lives with the world’s best transportation. Lyft is the fastest growing rideshare company in the U.S. and is available to 95 percent of the US population. Lyft is preferred by drivers and passengers for its safe and friendly experience, and its commitment to effecting positive change for the future of our cities.

About Lyft Business

Lyft Business offers travel, commute, event, and courtesy ride programs that provide customers with the tools they need to reduce cost, save time, and streamline their transportation programs. We partner with thousands of organizations to create unique solutions to move their people, from employees and customers to patients and students.

-

Carlson Wagonlit Travel research: business travelers from the Americas are best at staying in touch with family

According to the CWT Connected Traveler Study, half of business travelers from the Americas contact their families when on business trips, more than those from other regions. Only one-third (31%) of travelers from Asia Pacific (APAC) and around a quarter (27%) of Europeans touch base with their families while on the road.

The survey of more than 1,900 business travelers revealed that travelers from the Americas are also more likely to check-in more than once a day (47%), whether by phone, text, email, or other methods, compared with travelers from Europe (37%) and APAC (32%).

“Obviously business travelers miss family life when they are away, but most travelers make sure they stay in touch,” said Julian Walker, head of external communications at Carlson Wagonlit Travel.

While there were similarities across the Americas, Europe and APAC, the study exposed key differences in the ways and frequency with which business travelers connect with family. For example, European travelers (49%) are more likely to use a phone to communicate with family and friends while traveling compared with 43% of those from the Americas and 41% from APAC.

Conversely, travelers from the Americas (20%) are more likely to text family and friends than those from APAC (17%) or Europe (13%). Regardless of location, CWT’s research revealed that around a quarter of travelers from each region Skype their families.

“While technology continues to evolve, most travelers still favor traditional ways to connect with family and friends,” said Walker. “Digital tools, like video calls, are making it easier for travelers to feel more connected with their family when they’re away.”

About the survey

The CWT Connected Traveler Study was created by Carlson Wagonlit Travel and conducted through Artemis Strategy Group March 30-April 24, 2017. Survey data was collected from more than 1,900 business travelers between the ages of 25-65 from the Americas (Brazil, Canada, Chile, Mexico and the United States), Europe (France, Germany, Italy, Spain, Sweden and the United Kingdom) and APAC (Australia, China, India, Japan and Singapore). To participate in the study, business travelers were required to have made more than four business trips within the past 12 months. The purpose of this study was to understand how business travelers stayed connected to both work and home while on the road.

About Carlson Wagonlit Travel

Companies and governments rely on us to keep their people connected. We provide their travelers with a consumer-grade travel experience, combining innovative technology with our vast experience. Every day we look after enough travelers to fill almost 200 Boeing 747s and around 100,000 hotel rooms, and handle 95 corporate events. We have more than 18,000 people in nearly 150 countries, and in 2016 posted a total transaction volume of US$ 23 billion.

Follow us on Twitter and Linkedin

About Artemis Strategy Group

Artemis Strategy Group is a communications research firm specializing in brand positioning, thought leadership and policy issues.

-

Carlson Wagonlit Travel research: European travelers least worried about safety and security

Recently conducted research by Carlson Wagonlit Travel found that while more than one-third (37%) of European travelers are concerned about safety and security, their counterparts from other regions worry more. Travelers from the Americas say that they worry about safety and security nearly half of the time (47%), while Asia Pacific travelers worry the most (56%).

“Despite recent terrorist attacks, business travelers say they’re more worried about other things – and that’s surprising,” said Simon Nowroz, Carlson Wagonlit Travel’s chief marketing officer. “We found that, yes, the world seems scarier at times – but travelers believe they have more tools at their disposal to keep them informed and safe.”

Terrorism only ranks fifth (35%) among safety concerns, despite the high visibility of terrorist attacks. “Forgetting something needed for work” ranked higher (40%), as did “losing something important” (38%), “being robbed or attacked” (37%) – and even “weather conditions” (37%).

The CWT Connected Traveler survey of more than 1,900 individuals found that two-thirds (67%) of business travelers believe travel is safer today than in the past, as they have more tools to mitigate safety concerns. Seven out of ten travelers use at least one of their employer’s security protocols, such as traveler tracking or emergency contact profiles. And more than two-thirds (68%) buy travel insurance.

The study did reveal several findings of concern. For example, one in five travelers have cancelled a trip due to concerns about their safety and security. And 30% say they are worried about their health and wellbeing when it comes to traveling.

Regional differences

The study revealed some intriguing regional differences between the Americas, Asia Pacific (APAC), and Europe, Middle East and Africa (EMEA). For example, only 7% of APAC travelers said they were “not concerned” about personal safety while traveling for business. That percentage rose to 12% for Americas travelers and 21% among EMEA travelers. This is reflected in the fact that APAC travelers appear to be better prepared. For example, more than half (52%) of APAC travelers maintain an up-to-date emergency contact profile compared to 38% in the Americas and only 34% in EMEA.

APAC travelers are also more likely to sign up for notifications of real-time risks (41%). Only 33% do in the Americas, while only 29% do from EMEA. APAC travelers were also more likely to know ahead of time about local medical or security services providers. More than a third (35%) of APAC travelers planned for these services ahead, versus 25% in the Americas and 20% in EMEA.

“Today’s travelers are sophisticated,” said Nowroz. “They’re signing up for alerts, they’re paying attention to the news and they use the available tools at their disposal. So while travel may seem risky, they’re taking steps to stay safe.”

About the survey

The CWT Connected Traveler Study was created by Carlson Wagonlit Travel and conducted through Artemis Strategy Group March 30-April 24, 2017. Survey data was collected from more than 1,900 business travelers between the ages of 25-65 from the Americas (Brazil, Canada, Chile, Mexico and the United States), EMEA (France, Germany, Italy, Spain, Sweden and the United Kingdom) and APAC (Australia, China, India, Japan and Singapore). To participate in the study, business travelers were required to have made more than four business trips within the past 12 months. The purpose of this study was to understand how business travelers stayed connected to both work and home while on the road.

About Carlson Wagonlit Travel

Companies and governments rely on us to keep their people connected. We provide their travelers with a consumer-grade travel experience, combining innovative technology with our vast experience. Every day we look after enough travelers to fill almost 200 Boeing 747s and around 100,000 hotel rooms, and handle 95 corporate events. We have more than 18,000 people in nearly 150 countries, and in 2016 posted a total transaction volume of US$ 23 billion.

-

RoomIt by CWT and Expedia Affiliate Network partner to provide hotel content for business travelers

RoomIt by CWT, the new hotel distribution division of Carlson Wagonlit Travel, the leading global travel management company, today announces a new agreement with Expedia Affiliate Network (EAN), a brand within the Expedia group. This agreement will make rates and availabilities for EAN supply available to RoomIt and CWT clients, giving travelers access to 197,000 properties including 36,000 unique properties across the globe.

“CWT is committed to giving our clients the most options with the most competitive rates in the most places around the world,” said Scott Brennan, president, RoomIt by CWT. “Adding EAN to our available supply is making a significant investment to provide a better experience and stronger service for our travelers”.

EAN supply will be available globally offline, through the CWT To Go mobile application, through the RoomIt online booking tool, and on major OBTs. Also, travelers can expect a consistent experience with access to hotel content regardless of booking channel. In addition to the unique properties from EAN, RoomIt already offers hundreds of thousands of traditional properties currently available to RoomIt clients and their travelers. This means travelers will have access to a significant amount of rates and rooms around the world.

“We know business travelers are looking for options when it comes to choosing hotels,” said Alfonso Paredes, Vice President EMEA & LATAM, Expedia Affiliate Network brand. “This agreement gives travelers many more options while helping them find the hotel they want and getting rates that will enable them to stay within their compliance structure.”

About RoomIt by CWT

RoomIt by CWT is a division of Carlson Wagonlit Travel, a long-standing leader in business travel. RoomIt provides travelers with the rooms, rates, amenities, and loyalty programs they want,; while helping organizations control their budget and improve travel oversight.

About Carlson Wagonlit Travel

Companies and governments rely on us to keep their people connected. We provide their travelers with a consumer-grade travel experience, combining innovative technology with our vast experience. Every day we look after enough travelers to fill almost 200 Boeing 747s and around 100,000 hotel rooms, and handle 95 corporate events. We have more than 18,000 people in nearly 150 countries, and in 2016 posted a total transaction volume of US$ 23 billion.

Follow us on Twitter and Linkedin

About Expedia Affiliate Network

Expedia® Affiliate Network (EAN) is a global B2B partnership brand within the Expedia group that powers the hotel business of leading airlines, top consumer brands, travel agencies and hundreds of other partners through its API and template solutions.

-

Carlson Wagonlit Travel announces multi-year distribution agreement with British Airways and Iberia

Carlson Wagonlit Travel (CWT) today announced a multi-year distribution agreement with British Airways (BA) and Iberia Airlines (IB), enabling CWT customers to avoid the airlines’ proposed surcharge on bookings created within participating global distribution systems (GDS) that agree to these terms with IAG.

The agreement, effective 1 November 2017, applies to CWT business travel and leisure clients. CWT continues to work with all key parties, to provide further surcharge-free BA and IB content for its customers.

“This agreement further strengthens our long-standing partnership with BA and IB and highlights our mutual commitment to the concept of new distribution capabilities (NDC) to drive improved product differentiation,” said Brian Mogler, Senior Vice President, global supplier management, CWT. “While we believe GDSs provide the best technology platform available for CWT to enable best-in-market user experience and operating efficiency, we will continue to monitor and assess new technologies and capabilities.’

Ian Luck, Head of Distribution at British Airways, said: ‘We are delighted with this new agreement which will bring both immediate and longer term benefits. We are particularly pleased with the strong undertaking CWT has made to work collaboratively with us, GDSs and other technology partners in delivering NDC content and other benefits to our customers.’

In May 2017 International Airlines Group (parent company of BA and IB) announced it would add a US$10 ‘distribution technology charge’ on each airline fare component of a booking, effective 1 November 2017. A fare component is a portion of a journey, or itinerary, between two consecutive fare breaks, or legs so, for example, a round trip ticket typically contains two fare components and therefore would have an IAG surcharge of US$20.

About Carlson Wagonlit Travel

Companies and governments rely on us to keep their people connected. We provide their travelers with a consumer-grade travel experience, combining innovative technology with our vast experience. Every day we look after enough travelers to fill almost 200 Boeing 747s and around 100,000 hotel rooms, and handle 95 corporate events. We have more than 18,000 people in nearly 150 countries, and in 2016 posted a total transaction volume of US$ 23 billion.

-

CWT wins “Africa’s Leading Business Travel Agency 2017” award at the WTA Awards in Kigali, Rwanda

Carlson Wagonlit Travel, the global travel management company, has won the coveted “Africa’s Leading Business Travel Agency 2017” award at the prestigious World Travel Awards Africa Gala Ceremony, in Kigali, Rwanda.

“We are delighted to receive this award, which recognizes the hard work and dedication of our teams all across Africa,” said Francisco Nuñez, VP Global Partners Network at Carlson Wagonlit Travel. “African businesses are among the fastest-growing and most innovative and we are proud to be part of their success.”

With operations in 42 African countries, CWT has the largest presence of any international travel management company in Africa. Together with CWT’s fully-owned businesses in Egypt and Morocco, a joint venture in South Africa and CWT’s international partner’s network elsewhere, travelers have access to CWT’s award-winning products and services all across Africa.

CWT’s presence in Africa is driven by customer’s needs: many of CWT’s Energy Resource and Marine customers require travel management services in developing markets across the continent. CWT also looks after many customers in financial services, consulting, manufacturing and telecoms, both multinationals who operate there, and homegrown African businesses.

CWT specializes in providing innovative travel solutions to its customers – in particular, advanced online tools. In 2017, for example, CWT successfully deployed an online solution for a large energy customer in Republic of Congo, giving travelers real-time access and confirmation – a first for this market.

Meanwhile, many customers are looking to consolidate their travel management in one central hub. To meet that need, CWT set up a state-of-the-art Customer Service Center (CSC) in 2015, based in Johannesburg, South Africa, and serving customers across sub-Saharan Africa.

This hub model provides customers with a single point of contact for all of their African travel needs, but with the unique benefit of access to local Air and Hotel content, and billing in local currencies. For example, clients in Kenya whose travel program is managed through the CSC have access to specific local content and fares, just as if they were dealing with their local CWT office. Invoicing and payment take place inside Kenya, allaying concern around overseas payments.

In some markets, internet down-time and telecom issues impacts local service. The CSC solution thus ensures that customers can always book their travel through their dedicated team in South Africa. It’s a winning combination: local knowledge and tools, and the technological sophistication and worldwide coverage that comes with being part of a global network.

About Carlson Wagonlit Travel

Companies and governments rely on us to keep their people connected. We provide their travelers with a consumer-grade travel experience, combining innovative technology with our vast experience. Every day we look after enough travelers to fill almost 200 Boeing 747s and around 100,000 hotel rooms, and handle 95 corporate events. We have more than 18,000 people in nearly 150 countries, and in 2016 posted a total transaction volume of US$ 23 billion.

-

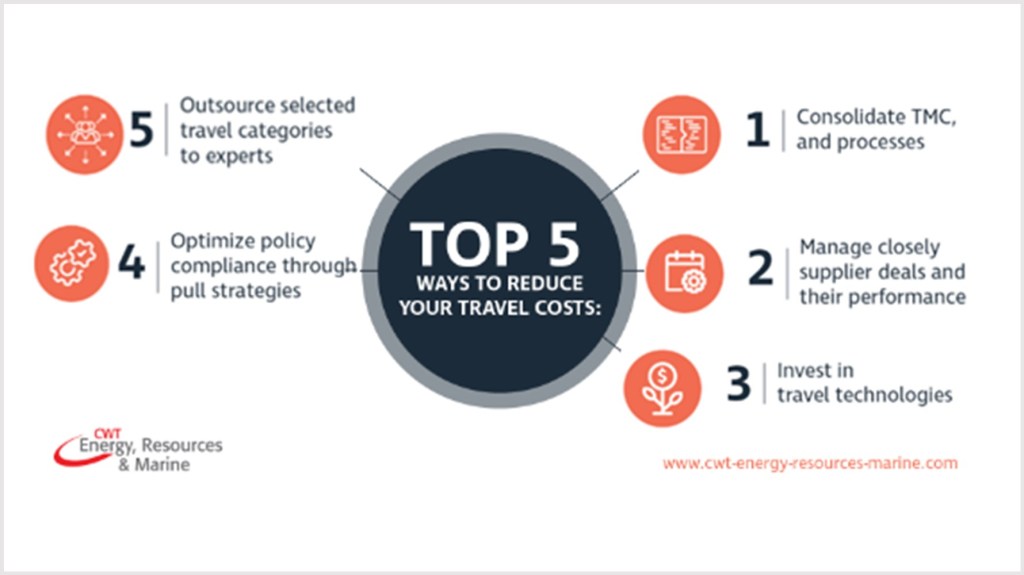

Recovering Energy, Resources and Marine sectors means higher travel pricing in 2018

Airfares and hotel rates in key locations for the Energy, Resources and Marine (ERM) sectors are expected to rise in 2018 – according to CWT Energy, Resources & Marine, the specialist division of global travel management company Carlson Wagonlit Travel.

As business activity in ERM industries increases, the annual 2018 CWT Energy, Resources and Marine Travel Forecast, published today, provides a region-by-region analysis and insight into travel conditions for key markets in the coming 18 months.

“Companies in this realm are finally set up to operate with profits despite the continued lower price of oil,” said Raphael Pasdeloup, senior vice president, CWT Energy, Resources & Marine. “We are seeing investments going up, especially within supply chains. With this increased activity ERM travel prices will rise, which means costs will need to be managed appropriately as budgets catch up.”

According to the International Monetary Fund, global GDP growth is expected to hit 3.6% in 2018. This, along with favorable foreign exchange rates (valued against the USD) within many ERM-dependent countries, will boost pricing. Expect operations in remote areas to see increased airline routes and hotel capacity, reversing the trend of the past couple of years.

Top recommendations for ERM travel in 2018:

The Forecast identifies four key areas where companies can manage expenditure against external, volatile and unpredictable factors impacting growth:

- Be Prepared – Start with unit cost optimization and asset utilization.

- Have a Robust Travel Policy – Build cost-effective supplier agreements to negotiate with hotel suppliers.

- Leverage Technology – Use software tools to manage the entire travel process.

- Be Mindful of Safety – Enhance the measures you already have in place with technology and review travel healthcare procedures.

While travel prices for the ERM sectors are broadly expected to rise across the globe in 2018, regional and local variations exist.

North America

In North America, the demand for hotels has leveled off since mid-summer 2016, but supply is still expected to continue growing steadily throughout 2018.

Uncertainty surrounds Houston, in the light of the devastating effects of Hurricane Harvey. Despite being one of the key energy production centers in the region, it continues to be challenged by low oil prices, with low hotel occupancy levels – just above 60%. Hotel rates in Houston are forecast to decline 2.2% in 2018.

However, in Canada we expect slightly stronger positive growth for the hotel market, where cities like Calgary are projected for hotel rates to increase by 3.8% in 2018.

Air routes that had been discontinued to oil-rich markets are expected to open up again as the market improves. Houston is set to be one of the major beneficiaries, and airfares are projected to increase 2% as a result. Other cities such as Chicago, with strong domestic carrier competition, or Los Angeles, with strong international competition are expected to benefit.

Latin America

The hotel market in South America is still very fragmented, with robust competition from a large number of brands and from independent operators.

Rio de Janeiro has an over-supply of hotel capacity, following the FIFA World Cup and the 2016 Summer Olympic Games, leading to rates falling by 3.8%.

The emergence of more low cost capacity is expected with air travel as Brazilian airline, GOL, increases its fleet. We’re also seeing the unbundling of fares, with airlines charging a base for booking a seat, and then separately for various ancillary services like checked baggage and meals. The overall impact is a reduction in ticket prices, however, with ancillary costs, the final prices for the entire journey may not be reduced or may even increase.

Europe, Middle East & Africa

For what is a very broad and diverse region, it’s unsurprising to see significant disparity between growth rates in its different countries.

Overall, strong growth is expected in hotel costs and capacity in Europe, but a much flatter trajectory in the Middle East and Africa.

Hotel rates in Stavanger, Norway are projected to increase steeply by 11.5% next year, driven by increased oil exploration. Double-digit growth in international arrivals is expected based on a combination of the oil industry and tourism, particularly from China.

We see a similar pattern with airfares. Strong growth is on the cards for Western and Eastern Europe, while Africa is set for moderate growth.

Asia Pacific

Centers of ERM activity in Asia Pacific have all felt and, in some cases, still feel the impact of a particularly bad few years. Some key destinations like Mumbai, Singapore and Tokyo are rebounding, while others like Perth are still struggling.

In China and India, rises in airfares and hotel rates are inevitable because of the macro-economic picture of ever-increasing domestic demand. Indeed, there are potential capacity issues on the horizon if demand in the region stays on its current path.

At the same time, airlines are developing their business models and governments are acting to impose some control on the market, in an effort to increase capacity in line with demand. Low cost carriers are also set to play a greater role in business travel with route expansion and the provision of premium cabins.

Still airfares across the region are set to rise, with Mumbai, Jakarta and Manila all expected to see the steepest increases of 7.7%, 7.0% and 6.0% respectively.

With mining picking up again, there will be pressure on specific routes, particularly in Australia. Companies have a legal duty to impose minimal impact on the local community and that includes working with the airline(s) to make sure there is enough availability, at a reasonable price, even when the mining industry is taking up every available seat.

About CWT Energy, Resources & Marine

CWT Energy, Resources & Marine provides specialized travel management solutions for organizations operating in oil and gas, diversified resources and mining, offshore, marine services and renewable energies. Building on more than 30 years of experience, we work closely with clients worldwide to find the right solutions for their complex travel needs, providing first-class service and leading-edge technology and products. CWT Energy, Resources & Marine is part of Carlson Wagonlit Travel – a global leader in travel, hotel booking and meetings and events.

About Carlson Wagonlit Travel

Companies and governments rely on us to keep their people connected. We provide their travelers with a consumer-grade travel experience, combining innovative technology with our vast experience. Every day we look after enough travelers to fill almost 200 Boeing 747s and around 100,000 hotel rooms, and handle 95 corporate events. We have more than 18,000 people in nearly 150 countries, and in 2016 posted a total transaction volume of US$ 23 billion.

-

CWT Meetings & Events named to the 2017 MeetingsNet CMI 25 list

MeetingsNet, a digital magazine and website dedicated to the meetings, incentives and events industry, named CWT Meetings & Events (CWT M&E) to its 2017 CMI 25 list, the meeting industry’s only comprehensive report on the 25 largest meeting and incentive management companies focused on the U.S. corporate market. The exclusive directory of full-service meetings and incentive management companies, now in its 11th year, provides a unique resource for meeting managers, incentive travel executives, and procurement professionals looking for experienced, professional outsourcing partners.

“We are focused on delivering engaging events and helping our clients achieve their strategic meetings management ambitions,” said Beau Ballin, senior director, business development, CWT M&E. “Our creative know-how helps us produce awe-inspiring events, and our logistics expertise guarantees professional meeting services, group travel, and compliance. Being named to the CMI 25 list for the 7th consecutive year is an affirmation of the hard work and quality that we provide across more than 35,000 meetings and events each year.”

As a group, the companies on the 2017 CMI 25 list executed more than 139,000 corporate meeting and incentive travel programs in 2016—representing over 12.5 million group room nights—and employed more than 9,000 people in the U.S. alone. “As these impressive numbers help reveal, meetings and incentive travel programs are extremely valuable to the businesses and cities that host them and to the participants who benefit from the networking and learning,” said MeetingsNet’s Hatch.

The CMI 25 list will be published in the September 2017 issue of the MeetingsNet tablet magazine and digital edition and on www.meetingsnet.com. Company profiles include statics on business volume, top customer markets, recent company news, leadership, and more.

The MeetingsNet editors selected CMI 25 companies based on several factors, including the number of meetings and incentive travel programs managed in 2016 and the total number of room nights represented by those meetings and incentives. They also considered the number of full-time employees at each company, as well as the percentage of the company’s 2016 revenues that came from organizing corporate meetings and incentives versus association meetings or other sources.

CWT Meetings & Events

CWT Meetings & Events (M&E) is an award-winning global corporate events management service. Representing all industry sectors, CWT M&E delivers comprehensive live, virtual and hybrid event solutions for thousands of customers every year. Ranging from end to end productions of some of the world’s largest and complex global conferences, through to intimate national teambuilding experiences.

Follow us on LinkedIn, Facebook and Twitter.

About Carlson Wagonlit Travel

Companies and governments rely on us to keep their people connected. We provide their travelers with a consumer-grade travel experience, combining innovative technology with our vast experience. Every day we look after enough travelers to fill almost 200 Boeing 747s and around 100,000 hotel rooms, and handle 95 corporate events. We have more than 18,000 people in nearly 150 countries, and in 2016 posted a total transaction volume of US$ 23 billion.

Please follow us on Twitter @CarlsonWagonlit and Linkedin

-

Meetings & Events industry costs on the up, trends to watch in 2018

The overall cost per attendee per day for meetings and events around the globe increased in 2017 and is expected to continue rising next year, according to the 2018 Meetings and Events Future Trends report.

Released today by CWT Meetings & Events (CWT M&E), a division of global travel management company Carlson Wagonlit Travel, the report shows the regional differences and cost projections as well as the latest industry trends and top destinations.

“Costs are rising in key M&E markets, globally,” said Cindy Fisher, senior vice president and global head, CWT M&E. “With a 3.7% increase in hotels and 3.5% rise in air fares projected for the coming year, that trend is likely to continue.”

This will have a significant impact on some of the top destinations: certain popular venues may see drop-offs next year. For example, the top three global destinations for meetings and events in 2017 were Paris, São Paulo, and Rio de Janeiro.

The global airline industry’s capacity is expected to grow around 7% in 2017 and 6% in 2018. The segmenting of air fares is broadening the appeal to travelers as they are able to purchase from options including a basic economy restricted fare or various upgraded fares, with specific service options. As for hotels, there is a progressive push from suppliers to move corporate buyers away from fixed, negotiated hotel rates and toward dynamic rate pricing.

Trends and tips to improve M&E in 2018:

Going beyond statistics to the root of what it means to hold a meeting or event, this report also explores the latest industry trends and recommendations: The top five being:

- Focus on ‘Why’ –Set clear objectives from the start and use them to define your budget. Put a major emphasis on attendee engagement and then measure.

- Budget – Always start with the value the meeting or event can generate. A clear ROI for all to see is key to continued investment and successful meetings.

- Attendee experience –Make the whole process as simple as possible.

- Technology –Use technology to make conversations easier, and create user-friendly personalized attendee experiences.

- Safety and security – Plan in line with the amount of risk for each situation for both physical and cyber security, and do not inconvenience attendees.

North America

North America has seen the cost per attendee per day increase by 3% in 2017 with new supply growth slightly exceeding demand. In the US, hotel and air travel prices are both expected to increase by 2.5% in 2018, with expectations that new supply growth and increasing demand will be about evenly matched.

Hotel prices are expected to increase in 2018. On top of that, domestic leisure travel has been increasing, meaning some hotels and resorts may limit group blocks at peak times.

According to CWT booking data, the top 10 destinations for meetings & events in North America in 2017 are:

- New York, USA

- Toronto, Canada

- Cupertino/San Jose, USA

- Chicago, USA

- Indianapolis, USA

- San Francisco, USA

- Austin, USA

- Houston, USA

- Orlando, USA

- Las Vegas, USA

Destinations such as Hawaii, Washington DC, New York and California’s wine region remain popular for meetings and events. We also expect to see a number of places in Arizona becoming more popular as new hotels come online in 2018. However, as long as demand outstrips supply, we’re unlikely to see much change from 2017.

Latin America

The cost per attendee per day for meetings and events in Latin America has increased by 1% in 2017. In 2018 we expect both hotel and airfare costs forecast to undergo nominal growth across the region, with some notable local variations.

Looking at hotels, a trend in the region – particularly Argentina – sees event organizers forfeiting luxury accommodation in exchange for better food and beverage options, enhanced Wi-Fi and more flexible services. This is driving demand in midscale hotels across the whole region. We expect venue costs to increase by 3-to-5% in popular markets like Colombia and Mexico, while the overall figure for the region is for venue costs to increase by 2%.

According to CWT booking data, the top 5 destinations for meetings & events in Latin America in 2017 are:

- São Paulo, Brazil

- Rio de Janeiro, Brazil

- Mexico City, Mexico

- Bogota, Colombia

- Buenos Aires, Argentina

*Only five destinations were selected as there is a significant drop of venues / destination demand after Buenos Aires

In 2018, we expect there to be an estimated 20% reduction in group sizes in Brazil due to the weakened economy as clients with less budget are looking to do more domestic events. Rio de Janeiro is set to host many events, buoyed by the new hotels and venues following last summer’s Olympic Games. However, there are major security considerations which will slow the city’s growth as an event destination.

Large scale hotel developments and refurbishments in Colombia are making it a desirable destination for the US M&E market. For instance, Medellin’s hotel accommodation is improving considerably, as are its convention centers. The coffee region is increasingly attractive because it is different and the costs are low.

Other lesser known destinations are beginning to make their mark in the region including the exotic – but still accessible – Atacama Desert in Chile, as well as Iguazu Falls on the border between Argentina and Brazil.

Europe, Middle East and Africa

The cost per attendee for meetings and events in Europe, Middle East and Africa has increased by 4% this year. Costs are increasing slightly while the economy across the region is flat, once you take inflation and currency fluctuations into account. In real terms meeting and events costs are going up incrementally, and this is expected to continue into 2018.

That said, Brexit could mark a major change for most of Europe. To date, the main impact has been to attract people to the UK due to the reduction in value of pound sterling. But it is too early to define what the ultimate impact will be – we’ll have a better idea by 2019 when the UK is scheduled to formally leave the EU.

The EMEA hotel market doesn’t have the same pressure on supply as the Americas. It isn’t much of a seller’s market, and hotels are unbundling costs. There is a move away from agreed-rate programs to rate caps as well as a shift from day-delegate rates to rates based on rooms, food and beverage, AV and so on.

According to Cvent data, the top 10 destinations for meetings & events in Europe, Middle East and Africa in 2017 are:

- London, England

- Barcelona, Spain

- Berlin, Germany

- Amsterdam, Netherlands

- Paris, France

- Madrid, Spain

- Frankfurt, Germany

- Rome, Italy

- Munich, Germany

- Prague, Czech Republic

It is impossible to ignore the impact of safety and security when it comes to venue selection in Europe, Middle East and Africa, with many countries being unavailable. Terrorist attacks in Barcelona, Berlin, Brussels, London, Manchester and Paris all have an impact as well, even if in the short-term.

Against that background, Italy and Portugal are becoming more popular with its reasonable pricing. Germany and the UK remain as popular as ever. Specific cities such as Berlin, Dusseldorf, Cologne and Vienna are attracting more interest.

There are also new destinations emerging particularly for the incentive market, led by Bordeaux, Toulouse, Palma de Mallorca. They are developing new structures and facilities, and have either existing or new travel connections, and offer low prices.

Asia Pacific

The cost per attendee, per day for meetings and events in Asia Pacific increased by 5% in 2017. Prices aren’t changing very much in Asia Pacific, for either hotels or air fares, with increases of 3.5% and 2.8% respectively.

Hotels largely remain the venues of choice across most of the region, particularly in China where new hotels open every week. Australia and New Zealand are outliers in the region in this respect as they haven’t seen much hotel development recently so there is more demand for unique venues.

Despite ever-increasing hotel stock in China, prices are set to continue to increase because of demand from both business and leisure travel.

According to Cvent data, the top 10 destinations for meetings & events in Asia Pacific in 2017 are:

- Singapore

- Sydney, Australia

- Bangkok, Thailand

- Kuala Lumpur, Malaysia

- Hong Kong

- Shanghai, China

- Melbourne, Australia

- Tokyo, Japan

- Mumbai, India

- Seoul, South Korea

Overall in APAC, security is limiting people’s desire to travel as Indonesia, Malaysia, the Philippines and Thailand all have some geopolitical challenges. Despite the threats, Thailand’s government is working hard to encourage people to continue coming, and the increasing number of visitors shows the impact local authorities can have.

China’s hotels are both innovative and hungry for business, with lots of different players and many hotel chains. The Chinese government’s policy of only using local hotels has further pushed down prices, which, combined with a relative absence of security concerns, has made China a good location for meetings and events.

Singapore remains a hub for meetings because of its abundance in relevant space and excellent air links. South Korea and Vietnam are emerging destinations especially as Pyeongchang, South Korea will be hosting the 2018 Winter Olympics next year.

Taiwan is also on the way up, though harder for Chinese citizens who need a special permit to travel there; that restriction will mean hotel prices remain stable, even though new hotels are opening, which is always a driver.

Tokyo has higher costs than other areas of Japan, even though it has great connections. Kyoto, Okinawa and Osaka are growing in popularity, particularly for people from APAC because there are direct flights.

CWT Meetings & Events

CWT Meetings & Events (M&E) is an award-winning global corporate events management service. Representing all industry sectors, CWT M&E delivers comprehensive live, virtual and hybrid event solutions for thousands of customers every year. Ranging from end to end productions of some of the world’s largest and complex global conferences, through to intimate national teambuilding experiences.

Follow us on LinkedIn, Facebook and Twitter.

About Carlson Wagonlit Travel

Companies and governments rely on us to keep their people connected. We provide their travelers with a consumer-grade travel experience, combining innovative technology with our vast experience. Every day we look after enough travelers to fill almost 200 Boeing 747s and around 100,000 hotel rooms, and handle 95 corporate events. We have more than 18,000 people in nearly 150 countries, and in 2016 posted a total transaction volume of US$ 23 billion.