Introducing the latest myCWT product and service enhancements

Building on our digital, omnichannel myCWT platform, our new products and services will simplify travel management for you and your employees – anytime, anywhere, anyhow.

Note: Featured services may not be available in your country at this time. Please reach out to your CWT representative for more details.

Hear from Chief Product Officer, Erica Antony as she shares the key product highlights of 2024, along with the key areas driving innovation.

-

2040: Baseline, Boom or Bust

As we enter an era of rapid transformation and unprecedented challenges, it is essential for travel managers, meeting & event planners, and corporate decision-makers to look ahead and frame our current strategic thinking with a clear vision of the future. Business travel and meetings and events (M&E) are poised for significant change over the next decade and a half, driven by a complex interplay of sustainability goals, technological advancements, evolving work models, and geopolitical dynamics.

In this paper to mark the 10th anniversary of our Global Business Travel Forecast, we explore, for the first time, a long-term vision of the future and potential trajectories through three distinct scenarios, each offering insights into how these forces should affect policy-making, budgeting and priorities. By examining these scenarios, we can better understand the diverse possibilities that lie ahead and the strategic imperatives required to thrive in each potential future.

Based on trajectory data analysis and interviews with industry leaders, behaviorists and climate tech founders, this forward-looking approach enables us to anticipate changes, strengthen our strategies, and make informed decisions that align long-term objectives. It is through this lens of foresight and adaptability that we can build resilience, seize opportunities, and navigate the complexities of the future.

We invite you to reflect on the insights presented, and consider how your organization can prepare for the opportunities and challenges that lie ahead. Together we can ensure that travel and meetings remain catalysts for growth, scalability and sustainable practices.

- Scenario development is both an art and a science

- Megatrends Shaping the Future of Business Travel, Meetings and Events

- Sustainability goals the new crux of corporate policy

- Technology Revolutionizes Travel Management

- Modern work models spark new travel patterns

- Changing demographics open doors to new opportunities

- Three Scenarios: Base case, boom and bust

- Future-proofing strategies

-

CWT GBTA Global business travel forecast 2025

When it comes to pricing, global business travel has finally reached an enduring, higher baseline. Prices will continue to rise in 2025, but only moderately, so expect a period of normalized growth.

However, this pricing environment, one of marginal gains and price regularity, is fragile. Global leisure travel has now realized a lot of its pent-up demand, while corporate travel has been resurgent, with 2024 edging at preCovid levels.

There are many factors at play, whether its volatile oil prices, labor costs and constraints, inflationary pressures, and geopolitical factors. As this elevated baseline edges upwards, albeit marginally, travel budgets will come under increased scrutiny, especially as travel patterns and attitudes change.

It’s why business travel can’t be viewed in a silo, and the true value to an organization must be fully realized. This forecast can help with those calculations.

-

Capitalize on emerging technologies in corporate travel

Technological advancements are accelerating at an unprecedented pace. How will emerging innovations like Generative AI, blockchain, and self-sovereign identity (SSI) transform corporate travel?

BTN and CWT probed global CEOs, travel managers, industry consultants and tech experts on the promises, questions, and expectations these innovations raise and how they are set to reshape traveler experience, cost control and service delivery in corporate travel and events.

Download and discover

- The technologies that will have the greatest impact on corporate travel in the next 2-5 years

- How these emerging technologies are poised to control costs, enhance service and security, and boost efficiency

- The critical challenges, opportunities, risks and roadblocks each innovation raises

- What travel managers, buyers and experts anticipate from these innovations

-

Hotel choice drives compliance

Many traveler managers struggle to increase hotel compliance. One CWT client found that by simply offering business travelers more choices, they make the right choice.

Challenge:

The company’s 5,000 travelers could not find accommodations via the GDS in all the cities they traveled.

Solution:

The client adopted full RoomIt content across all of their booking channels, including their Traveldoo booking tool, in order to provide their travelers with more hotel booking choices.

Results:

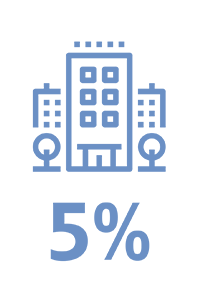

Growth in OBT Adoption after RoomIt content introduced

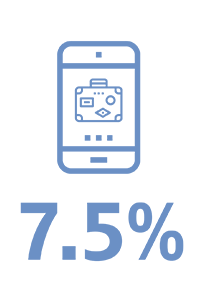

Growth in hotel attach after RoomIt content introduced

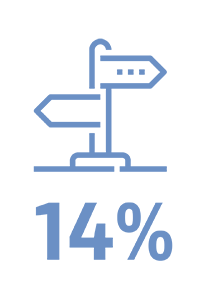

Percentage of total bookings made using third-party content

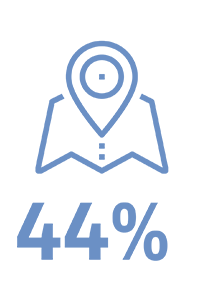

Third-party bookings at properties not available through the GDS

When your travelers book within policy and through your corporate channels, you can drive additional savings, improve your reporting and locate travelers more easily in an emergency.

-

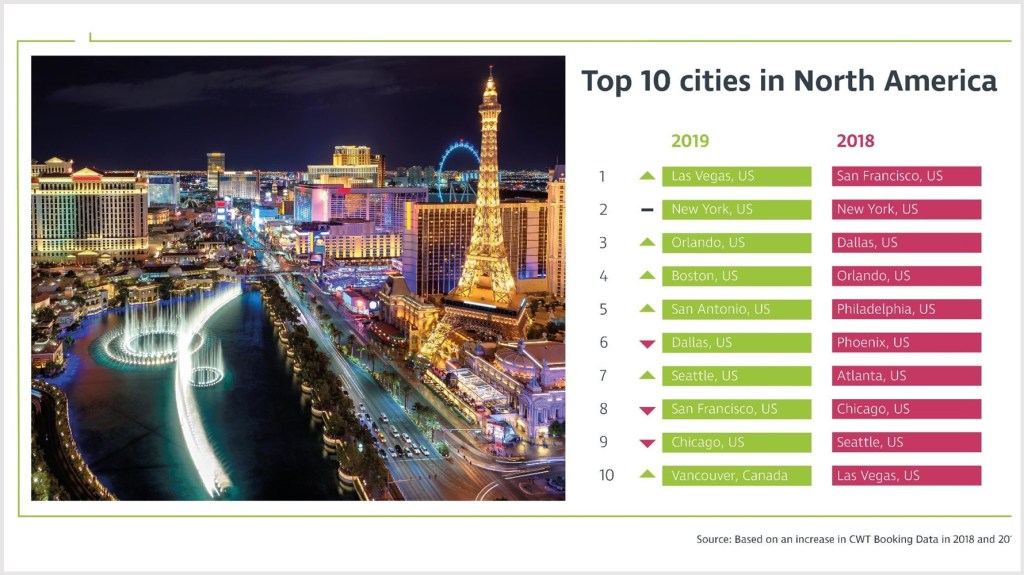

CWT Meetings & Events research: Las Vegas tops ranking for North America corporate meetings and events in 2019

CWT Meetings & Events, a division of global travel management company Carlson Wagonlit Travel (CWT), today unveiled its predictions for the top ten North American cities. The ranking is based on proprietary and industry data in CWT’s 2019 Meetings & Events Future Trends report, to be published next week.

2019 forecast for top ten North America meetings and events cities (2018/17 positions in brackets):

- Las Vegas, US (2018: 10 /2017: 10)

- New York City, US (2/1)

- Orlando, US (4/9)

- Boston, US (-/-)

- San Antonio, US (-/-)

- Dallas, US (3/-)

- Seattle, US (9/-)

- San Francisco, US (1/6)

- Chicago, US (8/4)

- Vancouver, Canada (-/-)

Next year’s ranking sees three new entries: Boston (4) and San Antonio (5), plus Vancouver (10) in Canada. Canada was last featured in the 2017 North American top ten cities with Toronto, then in second place. Cities that have dropped out of next year’s list include Philadelphia (5th in 2018), Phoenix (6), and Atlanta (7).

In the North America marketplace, cost per attendee per day is predicted to rise 1% in 2019, to an average of US$234. Average 2019 group size is projected to increase to 88, up 14% from 2018.

“Clients are mostly looking at upscale and luxury properties for their events – mirroring the strength of the US economy,” said Tony Wagner, Vice President, Americas, CWT Meetings & Events. “If customers can’t get availability, they are switching dates, or looking at a different destination to get the right property.”

The North America meetings market is likely to continue to be driven by robust economic growth in the United States, with forecasts from the International Monetary Fund putting US growth at 2.7% in 2019, a slight dip on 2018’s expected increase of 2.9%. GDP growth in Canada is expected to come in at 2% in 2019.

Lead times for events of 100-plus attendees, which require a ballroom and breakout spaces, are now being booked between four to six months in advance, while events for 400-500 delegates are being planned six to nine months ahead. Booking more than a year in advance is fast becoming the norm for major conferences and conventions.

The US pipeline for new hotels is strong, with an estimated 5,300 properties currently planned, adding more than 630,000 rooms across the country, and this upward trend of new openings is expected to continue. The US$1.5 billion expansion of the Javits Center in Manhattan alone will add 1.2 million square feet of new exhibition and meeting space from 2021.

One major city seeing a hotel capacity squeeze is San Francisco. That will keep prices high there – particularly as the city is already the number one meetings destination in the US this year.

CWT Meetings & Events

CWT Meetings & Events delivers 38,500 innovative, high-quality projects for customers every year – across all industry sectors, globally. Our creative know-how helps us deliver awe-inspiring events, and our logistics expertise guarantees professional meeting services, group travel, and compliance. We manage your strategic meetings management programs with one aim in mind – to maximize your return on investment.

CWT Meetings & Events is Carlson Wagonlit Travel’s meeting and events division.

Carlson Wagonlit Travel

Companies and governments rely on us to keep their people connected. We provide their travelers with a consumer-grade travel experience, combining innovative technology with our vast experience. Every day, we look after enough travelers to fill more than 260 Boeing 787s and 100,000 hotel rooms – and handle 105 events. We operate in around 150 countries, and in 2017 posted a total transaction volume of more than US$ 23 billion.

-

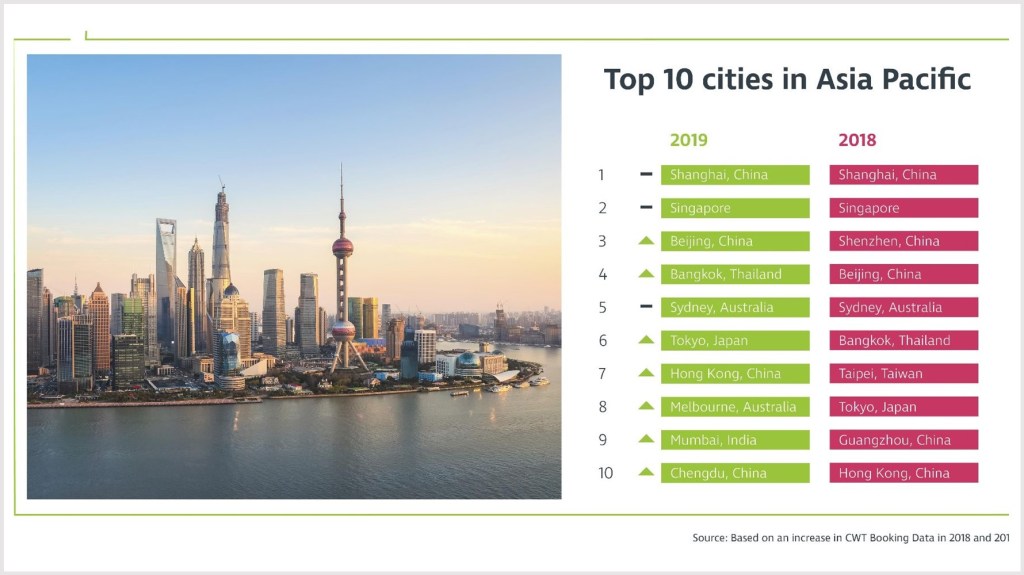

CWT Meetings & Events research: Chinese cities to dominate Asia Pacific destinations for corporate meetings and events in 2019

CWT Meetings & Events, a division of global travel management company Carlson Wagonlit Travel (CWT), today unveiled its predictions for the top ten Asia Pacific cities for M&E in 2019. The ranking is based on proprietary and industry data in CWT’s 2019 Meetings & Events Future Trends report, to be published next week.

2019 forecast for top ten Asia Pacific meetings and events cities (2018/17 positions in brackets):

- Shanghai, China (2018: 1 /2017: 6)

- Singapore (2/1)

- Beijing, China (4/-)

- Bangkok, Thailand (6/3)

- Sydney, Australia (5/2)

- Tokyo, Japan (8/8)

- Hong Kong, China (10/5)

- Melbourne, Australia (-/7)

- Mumbai, India (-/9)

- Chengdu, China (-/-)

Next year’s table has one brand new entry, China’s Chengdu (10) and two cities that dropped out of the top ten in 2018 – India’s Mumbai (9) and Melbourne, Australia (8). Of the three cities who dropped off next year’s list, two were new entrants in 2018 – Taipei in Taiwan (7), and China’s Guangzhou (9) – and one was a former high flyer, Shenzhen in China, which came third in 2018.

Across Asia Pacific, cost per attendee per day is predicted to fall 4% in 2019 to US$276. The average group size is forecasted to increase to 81 in 2019, up 3% from 2018.

“We continue to see a steady growth in the demand for meetings and events across Asia Pacific,” said Sam Lay, Senior Director, Asia Pacific, CWT Meetings & Events. “This is fueling the need for more M&E professionals in the region, especially in China which is barreling ahead on all fronts.”

The Asia Pacific region is expected to lead the way for global growth in 2019, with the International Monetary Fund expecting the region’s GDP to rise by 5.6% next year, compared with a global increase of 3.9%. China, predicted to grow 6.4% in 2019, and India, predicted to grow 7.3%, will again lead the way.

Travel is growing hugely in China across all sectors, and it is already the world’s largest business travel market. Chinese tourists also spent US$258 billion on international tourism in 2017, according to the UN’s World Tourism Organization.

The more mature destinations in the region – Singapore, Hong Kong, Tokyo, and Seoul – are leading the way when it comes to hosting conferences that focus more on ‘thought leadership’ and the ‘exchange of ideas’ rather than pure commerce.

In growing markets, such as Vietnam, Philippines, and Cambodia, there are strong demand for exhibitions and trade shows, where there is a lot more activities centered around buying and selling.

Domestic events are also a huge part of the meetings and events market in more isolated parts of the region, including Australia and New Zealand. The Australian cities of Sydney – the region’s 5th most popular destination for 2019 – and Melbourne still hold considerable attraction as venues for regional and global conferences, despite long travel times.

Another destination set to see plenty of attention next year is Japan, which will host the 2019 Rugby World Cup tournament, followed by the 2020 Olympics in Tokyo. The country’s government wants to increase visitor numbers to 40 million in 2020, a 40% rise on 2017, with plans for 60 million arrivals by 2020.

CWT Meetings & Events

CWT Meetings & Events delivers 38,500 innovative, high-quality projects for customers every year – across all industry sectors, globally. Our creative know-how helps us deliver awe-inspiring events, and our logistics expertise guarantees professional meeting services, group travel, and compliance. We manage your strategic meetings management programs with one aim in mind – to maximize your return on investment.

CWT Meetings & Events is Carlson Wagonlit Travel’s meeting and events division.

Carlson Wagonlit Travel

Companies and governments rely on us to keep their people connected. We provide their travelers with a consumer-grade travel experience, combining innovative technology with our vast experience. Every day, we look after enough travelers to fill more than 260 Boeing 787s and 100,000 hotel rooms – and handle 105 events. We operate in around 150 countries, and in 2017 posted a total transaction volume of more than US$ 23 billion.

-

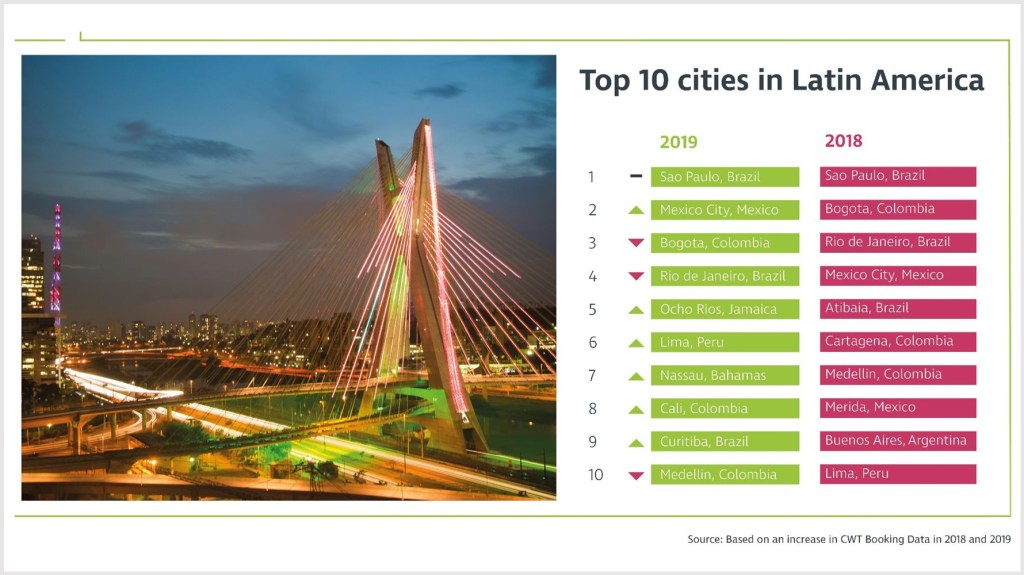

CWT Meetings & Events research: Sao Paulo to defend top spot for Latin America corporate meetings and events in 2019

CWT Meetings & Events, a division of global travel management company Carlson Wagonlit Travel (CWT), today unveiled its predictions for the top ten Latin American cities. The ranking is based on proprietary and industry data in CWT’s 2019 Meetings & Events Future Trends report, to be published next week.

2019 forecast for top ten Latin America meetings and events cities (2018/17 positions in brackets):

- Sao Paulo, Brazil (1 /1)

- Mexico City, Mexico (4/3)

- Bogota, Colombia (2/4)

- Rio de Janeiro, Brazil (3/2)

- Ocho Rios, Jamaica (-/-)

- Lima, Peru (10/-)

- Nassau, Bahamas (-/-)

- Cali, Colombia (-/-)

- Curitiba, Brazil (-/-)

- Medellin, Colombia (7/-)

Next year’s rankings feature four new entries: Jamaica’s Ocho Rios (5), Nassau in the Bahamas (7), Colombia’s Cali (8) and Curitiba in Brazil (9). Many of the cities that dropped off the list for next year were new entrants in 2018 – Atibaia in Brazil (5), Colombia’s Cartagena (6), and Merida in Mexico (8).The capital city of Argentina, Buenos Aires, has declined as a top meeting location from 2018, when it was in ninth place and 2017, when it was fifth. It did not place in the top ten cities predicted for 2019.

In Latin America, cost per attendee per day is predicted to increase by 3% in 2019, to an average of US$232. Meanwhile, average 2019 group size is forecasted to fall to 54, a 5% decline from 2018.

“While Brazil is now moving out of a difficult economic situation, clients had to change the way they operate,” said Gustavo Elbaum, Latin America Director, CWT Meetings & Events. “Customers are doing more events now, but they are taking better care of their budget and there is a much sharper focus on results.”

While there are always challenges across this vast region, there are signs that improving economic conditions are increasing demand for meetings, economic growth is still expected to be relatively slow next year, coming in at 2.3%, according to the World Bank. CWT Meetings & Events’ research predicts hotel prices will fall by 1.3% in 2019, while air prices will drop by 2%.

Colombia is expected to continue to be a stable market in 2019 with growth in meetings demand, helped by more inward investment by international companies, new hotels and new airline routes. The capital Bogota has remained near the top of the destinations list over the last three years.

There has been no drop-off in meetings demand in Mexico following the election of López Obrador in July. There are worries over how the ongoing renegotiation of the North American Free Trade Agreement (NAFTA) with the US and Canada might affect the Mexican economy.

Other countries in the region, such as Peru and Chile, continue to see stable meetings demand. Both countries are heavily reliant on the mining sector.

In Latin America, organizations tend to travel within their own country when it comes to meetings and events due to budget limitations. This is particularly true in Brazil and Argentina. Clients in Colombia and Mexico tend to travel more frequently around the region.

Brazil has seen the largest growth in hotel development in recent years, particularly in the lead-up to the 2014 World Cup football tournament and 2016 Olympics in Rio de Janeiro. But the recession has led to major global hotel brands dropping some properties. Local companies have stepped in to take their place. Some older five-star hotels have also cut some services to drop down to four-star level so they can compete for meetings business in the heavily regulated pharma sector.

Meanwhile, Rio de Janeiro’s reputation as a meetings destination has suffered following an increase in violent crime in the city since the Olympics two years ago. However, Rio is still a popular option, ranking number four in the region’s top destinations.

CWT Meetings & Events

CWT Meetings & Events delivers 38,500 innovative, high-quality projects for customers every year – across all industry sectors, globally. Our creative know-how helps us deliver awe-inspiring events, and our logistics expertise guarantees professional meeting services, group travel, and compliance. We manage your strategic meetings management programs with one aim in mind – to maximize your return on investment.

CWT Meetings & Events is Carlson Wagonlit Travel’s meeting and events division.

Carlson Wagonlit Travel

Companies and governments rely on us to keep their people connected. We provide their travelers with a consumer-grade travel experience, combining innovative technology with our vast experience. Every day, we look after enough travelers to fill more than 260 Boeing 787s and 100,000 hotel rooms – and handle 105 events. We operate in around 150 countries, and in 2017 posted a total transaction volume of more than US$ 23 billion.

-

Digging for gold – Revealing unmanaged expenses

If you have been in travel management for a while, you have probably redefined your travel program to a state-of-the-art level – trimming traditional travel expenses like air, hotel and ground transportation to perfection.

By now, you know it all: How to leverage your buying power with suppliers, how to combine your transient travel with your meetings and events spend, how to adjust the policy so travelers book well in advance, how to negotiate the best deals…

However, are you sure you are getting the full picture of your travel and expenses (T&E) spend and supplier usage? A lack of visibility can lead to decisions being made based on incomplete and incorrect information often leading to missed saving opportunities.

Fortunately, we launched a tool that allows you to see the goldmine more easily, and keep all expenses under your radar: CWT Travel Consolidator.

This web-based platform combines air, hotel and ground transport transactions booked regardless the channels – with credit cards, expense and HR data. By revealing the hidden costs of business travel and off-channel spend, the tool enables you to identify missed savings opportunities, improve compliance and increase your organization’ negotiating power with suppliers.

It also allows you to discover unmanaged expenses. For instance, one of our clients saw her company was spending on meals an average of $6.5 million with Starbucks and Hilton Hotels. She also discovered that three of their ten top meal suppliers were hotel chains, something that allowed her to negotiate better prices with suppliers.

Meals are not an expenditure to be taken lightly. According to a recent survey produced by the BTN Group, dining alone typically has comprised about 11% of an organization’s travel and entertainment spending.

Some buyers also said meals were their third-largest travel expense, after air and hotel and, for pharmaceuticals, meals can represent nearly half of the T&E budget.

But meals are not the only hidden cost. Another client discovered they were not tracking 50% of their total $110 million T&E spend: $23M on air, hotel and car rental booked outside CWT; $16.5M on meals, $6.5M on transportation and $10M on other expenses.

As you can see, there is a lot of money on the betting table, so make sure you track all the different expenditures to make the smart moves needed to save on your travel program.

-

The expert view: 5 ways to upgrade your events program

You only have to look at the stratospheric rise of social media platforms predicated on being photographed at cool places with cool crowds, clutching cool cocktails or the recent launch of experiential brands like Airbnb Experiences, to see that the balance has shifted. We’re moving faster than a canape waiter from a material economy to an experience economy, powered by investment in experiences. As Steve Howard, head of IKEA’s sustainability unit says “we’ve probably reached peak stuff.”

Like with most consumer trends, the effects are felt in the corporate world. It’s not surprising. There’s a ton of neuroscientific research that points to the value of in-person interaction for boosting productivity, creativity and wellbeing. Major hotel brands are investing in their meetings and events capabilities globally and while our future trends report forecasts 6% growth in 2019, Ian Cummings, VP CWT Meetings and Events, believes it could be closer to 12%.

Companies have to continue getting smarter about their events program if they want to remain competitive, manage their money and attract and inspire the best talent.

We asked Ian Cummings for his sage advice to take meeting planners into the future.

1. Appeal to Millennials

According to a study by Eventbrite, 3 out of 4 Millennials prefer experiences over things. Businesses would do well to get them on side, “More Millennials are attending events and meetings on behalf of their companies,” says Ian. “We now need to ensure that we cater for multiple demographics and not alienate anyone. To appeal to this group it has become increasingly important to incorporate major social media impact into event plans – especially when it includes virtual sharing for those that can’t be present. This ensures that audience and engagement doubles or even triples.”

Millennials: Integrate them, don’t alienate them. 2. Choose the road less traveled

“Most companies have covered the main capitals like Barcelona, London and Paris but are looking further afield now as they can get better rates and more value for money,” says Ian, “For example, we deliver a major annual event with one of our pharmaceutical clients, spread across multiple properties in Liverpool and this would cost so much more to hold that same event in London.”

Choose a less obvious location such as Liverpool over London. 3. Many happy returns

“Many companies still don’t measure return on investment (ROI) on their major events, but they wouldn’t spend the same amount on a piece of software without having relevant measures to ensure they’re getting true value for money,” says Ian, “ For others there has been a shift from savings to value creation, which is a more difficult measure. It will be important to have more conversations with Chief Marketing Officers and Commerce Officers of companies to ensure that events are strongly established within their marketing budget and they are getting their measurable ROI for that 30% or so of that marketing mix spend. I’m excited about the future and I’m looking forward to doing so much more with our clients.

ROI: Only what gets measured, gets managed 4. Tech it one step forward

Technology developments have been quite sporadic and disconnected within the meetings and events industry, but it’s slowly coming together, “Event management platforms, registration sites, apps for events, follow up surveys -These are often managed over various different platforms that someone has to manually collate and bring together. It’s more appropriate to have a universal technology platform that brings all that information together. No meeting or event planner wants to be dealing with three or four pieces of technology, repeating data input and trying to extract data in a format that the client wants. Technology has to improve and connect. It’s crucial to work with a company that has a clear technology roadmap globally.”

CWT Meetings and Events is moving to a unified platform with two pieces of technology at the center of the ‘umbrella platform.’ Within a short space of time, the same technology will be available for all markets across the globe – a truly global solution. “It is important for the consolidation of data,” says Ian, “and it allows all of our global customers to get a full breakdown of spend and value to support strategic decision making.

Technology: Consolidation is key 5. Time for a C-Change

It’s critical to elevate the conversation to C-suite execs. The Chief Marketing and Commercial Officers, CEO and CFO need to be involved in the high-level decision-making around events.

Ask an Exec: Events must reflect overall business goals. “If you take a large technology company and consolidate spend on events and training it amounts to millions,” says Ian. “C- suite level execs should be aligning event objectives with overall company strategies, where they want to go, and what they want to do or achieve within their event. If its savings then the venues and hotels selected should reflect that. If they’re after growth and a dynamic year then it’s about going all-out. The tone and direction of the company must be reflected through the events and this can only happen very early on in the strategic discussions.”

For more tips, trends and insight visit CWT Meetings and Events.

-

CWT Meetings & Events named to MeetingNet’s 2018 CMI 25 List

MeetingsNet, a digital magazine and website dedicated to the meetings and incentives industry, has named CWT Meetings & Events (CWT M&E), a division of global travel management company CWT, to its 2018 CMI 25 list of the largest full-service meeting and incentive travel management companies focused on the U.S. corporate market.

As a group, the companies on the 2018 CMI 25 list executed more than half a million corporate meetings and nearly 8,000 incentive travel programs in 2017.

“The 2018 CMI 25 list is an extraordinary resource for corporations looking for a, experienced meeting planning partner. It allows them to get a fix on the focus, strengths, and size of these large third-parties,” said MeetingsNet Content Director Sue Hatch. “In a fast-evolving industry that demands top technology, endless creativity, and absolute attention to detail, the CMI 25 companies have found success.”

“Our team is focused on providing creative, engaging events for our clients and offering industry leading strategic meeting management solutions leveraging innovative technology,” said Tony Wagner, vice president, Americas & South Pacific, CWT Meetings & Events. “Being named to the CMI 25 list for the 9th consecutive year is a reflection of our company’s dedication and our team’s hard work. It is truly a great honor to be recognized in the industry.”

The CMI 25 list is published in the September 2018 issue of the MeetingsNet tablet magazine and digital edition (http://www.meetingsnet.com/digital-edition), and on www.meetingsnet.com. Company profiles include statics on business volume, top customer markets, recent company news, leadership, and more.

In 2018, CWT Meetings & Events gained several stand-out clients, including two Fortune Top 25 customers, a national leading restaurant company and a fast-growing medical device company. CWT hosted events around the globe for Environmental Awareness Week and successfully executed the annual Carlson Employee Giving Campaign, the company’s largest community-based initiative.

In addition, as the host city for Super Bowl LII, Carlson Companies partnered with the City of Minneapolis and the Super Bowl Committee to lead efforts to fight sex trafficking in the hospitality industry. Carlson played an important role in the development of the Anti-Sex Trafficking Plan for Super Bowl LII and developed a plan that can be distributed and replicated by other cities and venues for future large-scale events.

CWT Meetings & Events also conducted many Corporate Social Responsibility (CSR) events with clients, including taking 500 people from local manufacturing giant 3M to Maui as part of an incentive trip and CSR initiative, to regenerate natural farming practices centered on Hawaiian culture.

The MeetingsNet editors selected CMI 25 companies based on several factors, including the number of meetings and incentive travel programs managed in 2017 and the total number of room nights represented by those meetings and incentives. They also considered the number of full-time employees at each company, as well as the percentage of the company’s 2017 revenues that came from organizing corporate meetings and incentives versus association meetings or other sources.

CWT Meetings & Events

CWT Meetings & Events (M&E) is an award-winning global corporate events management service. Representing all industry sectors, CWT M&E delivers comprehensive live, virtual and hybrid event solutions for thousands of customers every year. Ranging from end to end productions of some of the world’s largest and complex global conferences, through to intimate national teambuilding experiences.

Follow us on LinkedIn, Facebook and Twitter.

About Carlson Wagonlit Travel

Companies and governments rely on us to keep their people connected. We provide their travelers with a consumer-grade travel experience, combining innovative technology with our vast experience. Every day we look after enough travelers to fill almost 200 Boeing 747s and around 100,000 hotel rooms, and handle 95 corporate events. We have more than 18,000 people in nearly 150 countries, and in 2016 posted a total transaction volume of US$ 23 billion.

-

Higher oil prices, trade tensions fuel pricing for energy, resources and marine sector

Companies in the Energy, Resources and Marine sectors (ERM) are rebounding as oil and commodity prices continue to rise and global GDP growth is projected to increase 3.4% in 2019. Travel activity is also on the up, with air prices expected to climb 2.6% globally next year, according to the 2019 Energy, Resources & Marine Travel Forecast, published today.

“After a few challenging years, we saw a slow but steady recovery in 2018. We look forward to a more positive outlook for the year ahead – though with a few big caveats,” said Raphaël Pasdeloup, Senior Vice President, CWT Energy, Resources & Marine. “We expect continued growth in energy, metals and minerals commodities, as well as shipping. But geopolitical tensions, including around trade and Brexit, and a host of new and untested governments, especially in Latin America, could throw this positive trajectory off-course.”

“While these factors make forecasting difficult, we project air and hotel prices to rise nearly everywhere in the sector in 2019,” said Pasdeloup.

ERM industry activity and investments are closely correlated with the price of oil and commodities. Tight crude supplies, exacerbated by US sanctions against Iran, beginning 4 November, are projected to contribute to higher prices. Meanwhile, US exploration and production budgets increased to $132.5 billion this year, up from only $88.2 billion in 2016, when oil prices crashed.

Total world rig count is at the highest level since 2015, when it numbered 2,337 before plunging to 1,593 in 2016. The latest Baker Hughes Rig Count reports a healthy 2,273 rigs in operation. Companies in the ERM sector are poised to take advantage, having emerged from the recent downturn leaner and more efficient.

Growth in the marine sector is expected to be fairly flat, but container transport vessels are seeing an increase in work as the overall economy picks up. However, China, a key hub of container transport, is now seeing growth moderating, contributing to the slower outlook for the sector.

Renewables are on a different trajectory as the fastest-growing energy market globally. While this trend is set to continue, renewables still only account for about 3% of global primary energy consumption.

While there are expectations of an uptick in travel activity overall, companies are likely to stick to their prudent ways, booking the lowest available fares, even as airlines pile on the ancillary fees. Revenues from these fees rose to $82.2 billion in 2017, up from $32.5 billion in 2011.

Trade spats hurt growth expectations

Meanwhile, escalating trade tensions are a source of concern. Tariffs on steel and aluminum are increasing costs for producers. Trade spats may also dampen global growth, and thus demand for energy. Beleaguered trade deals such as NAFTA, which demonstrated how energy integration in the region can be achieved, are now creating uncertainty.

The US fisheries industry is increasingly alarmed by the trade war between the U.S. and China, which may impact global supply food chains, and cause companies to ease back on investments, including in travel. The impact is felt most keenly in Alaska, which represents 60% of all seafood caught in the United States. More than half of it is shipped overseas for secondary processing.

Any levy imposed on seafood imported from China will include Alaska products reprocessed in the country. Additionally, China has threatened a retaliatory 25% tariffs on U.S. seafood products, including those produced in Alaska.

Key regional highlights

- Asia Pacific

As oil prices continue their upward trend, the outlook for the Asia Pacific region is more positive than elsewhere. India is seeing sustained growth, and Australia is on track to become the world’s leading liquefied natural gas (LNG) exporter. The mining sector also looks set for a new wave of investments, most notably in Australia.

Singapore, an important hub in the region, is becoming a key center for refining of oil by-products. That is benefiting hotels as beds are added to keep up with demand. The Chinese market is also growing, specifically midscale brands like Hampton by Hilton, as travelers opt to stay in their preferred hotel brand.

- Europe, Middle East, and Africa

Projections for Nigeria and Angola suggest that prices in USD will go down significantly, as local currencies depreciate dramatically against the dollar. In their local currency, those markets are still poised for growth.

Price increases are likely to be lower in the Middle East than elsewhere due to competition between airlines. Most African destinations are expected to see traffic volumes rise as exploration picks up, driving up prices. In Europe, Brexit continues to be a source of uncertainty, with March 2019 currently still set as the official exit date. Whether corporations decide to move their headquarters out of the UK will determine how much — and where — there will be a traffic increase.

- Latin America

In Latin America, prospects are mixed. Various economies like Colombia, Peru and Chile are on the road to recovery and likely to see small airfare increases. Colombia also reported high occupancy rates in the first half of 2018, with increasing exploration in the country seen as one of the contributing factors.

The Brazilian ERM market is recovering too, but a recently ratified Open Skies deal with the US will see airline competition increase, and likely temper any price hikes.

Oil-rich Venezuela has seen a collapse in crude production after years of underinvestment and mismanagement. This has led to projections of a 10.1% contraction in 2019, according to Fitch, as oil production fell 28.1% this year.

- North America

Air prices in the U.S. are likely to go up next year in line with general economic growth, barring any severe consequences from current trade tensions. The big oil companies should be in a better negotiating position than in previous years, which may help mitigate the overall price increase.

In Canada, Calgary will experience a sharp price increase for both air and hotel, caused by inflation pressure on the housing market and a minimum wage that is set to rise, as well as an expected drop in exports. Canadian oil sands production is projected to go up more than half a million barrels per day in 2019, according to IHS Markit, as the country fills the void left by Venezuela.

Safety and security

Safety and security is always a concern in ERM travel, especially as many key markets or exploration hubs are located in volatile areas, including many mining destinations in Africa threatened by militant groups.

Technology

Technology plays an increasingly large role in travel, including in the ERM sector. One of the biggest challenges for this sector is the complexity involved as travel typically includes multiple steps, combining commercial bookings with campsite or dorm management, remote non-commercial travel and other highly variable factors. Companies are looking for a simplified process that includes one easy workflow incorporating all the steps of ERM travel booking.

About the 2019 ERM Travel Forecast

The annual Energy, Resources & Marine Travel Forecast is CWT’s definitive guide to travel in the sector, along with the macroeconomic, geopolitical, market and technology trends that are influencing prices and impacting the industry globally, by region and at the country-level.

About CWT Energy, Resources & Marine

We provide specialist travel management solutions for many of the world’s leading companies in the oil & gas, mining, offshore, marine and alternative energies industries. With our rich heritage and experience, we help our clients find the right solutions for their complex travel needs, often in some of the least accessible places on earth. We are proud to be part of CWT – a global leader in travel, hotel booking and meetings & events.

CWT

Companies and governments rely on us to keep their people connected. We provide their travelers with a consumer-grade travel experience, combining innovative technology with our vast experience. Every day, we look after enough travelers to fill more than 260 Boeing 787s and 100,000 hotel rooms – and handle 105 events. We operate in around 150 countries, and in 2017 posted a total transaction volume of more than US$ 23 billion.

-

Music for Mandela – Inside a six-city tribute tour

How do you celebrate the centennial of one of the 20th century’s most towering figures?

The Minnesota Orchestra honored former South African President Nelson Mandela with a two-country, six-city, six-performance tour that took them to London and five cities in South Africa—becoming the first professional U.S. orchestra to perform in Mandela’s birthplace.

Accompanying the orchestra on its historic two and a half week tour are about 80 of its most passionate supporters and patrons. Marilyn Carlson Nelson, former chair and CEO of Carlson Companies, CWT’s parent, is this year’s chair of the Minnesota Orchestra board. She brought in CWT Meetings & Events to orchestrate a complex program for the orchestra’s benefactors.

“We’re facilitating not just the travel [for the patrons], but their on-the-ground experience that moves in concert with the orchestra,” said Beau Ballin, senior director, business development, CWT Meetings & Events, who leads the sales team responsible for the project. “We’re really proud of the overall event that we’ve put together and the critical mass that was achieved.”

From a jazz cruise to an art & wine tour, safaris, diamond mine exploration and a poignant visit to Robben Island, a World Heritage site where Mandela was incarcerated for nearly 27 years, CWT M&E conceptualized and managed the program and its many moving parts for over a year—working in tandem with its ground partners and closely coordinating with the orchestra.

The patrons visit Robben Island ©Minnesota Orchestra “We felt like the composers of this tour,” said Jordan Bronston, director of business development, CWT M&E, who oversaw the program in South Africa. “Given the unbelievable complexities of this program—including 14 different attendee types, five safari lodges, five performance locations, three hotels, dozens of restaurants & activities, US embassy & consulate offices, and local Minnesota partners—we were able to conduct a beautiful movement of people, culture & experiences.”

It was a high-level, high-touch, white-glove leisure experience that differs from the usual incentive trips, conferences and meetings planned by CWT. While M&E organizes high-end travel experiences for its clients all the time, those attendees are typically employees of an organization following a program designed for them.

“Here, the participants had an agenda, and we worked to fulfill what they had on their agenda,” said Marita Morgan, senior meetings & events planner, CWT M&E, who managed the London part of the program. These included additional side trips, any itinerary changes, and accommodating friends or family joining an event at the last minute. “It was a reverse role.”

But one that CWT M&E executed in harmony with the orchestra.

“A project of this scale and complexity required the level of professionalism and expertise that CWT provided. From project inception to execution, we worked closely as a team,” said Angela Skrowaczewski, director of special events, Minnesota Orchestra, who praised CWT’s “can-do flexibility to adjust as the situation called for.”

Then, there was the music, the meaning, and the man.

In South Africa, the orchestra traveled from Cape Town to Durban, Pretoria to Soweto and finally, to Johannesburg. They performed at a university, at city halls, and in a sacred church that was the center of organization for freedom fighters during the violent apartheid years, and later, as the venue of the Truth and Reconciliation hearings.

In London, the orchestra performed a sold-out concert at the historic Royal Albert Hall where Kelly Kuhn, CWT’s chief customer officer, was among the enthusiastic crowd, cheering on the Minnesota Orchestra as it performed a rousing encore of Shosholoza, a traditional miner’s song that Mandela sang while doing hard labor.

“It was such a surprise to everyone that the entire audience was on their feet,” Kuhn said. “You could feel the incredible love for the music, the orchestra, Minnesota and Mandela,” she added.

“It was really quite powerful.”

-

People for privacy – How to keep your staff safe online

Anyone with access to the Internet can put your company at risk.

Protecting clients’ personal information is a business imperative, And now more than ever, it’s crucial to be transparent about the use of data. That means putting in place the right policies and technical controls to safeguard information.

Investing in the latest and best technology is an essential part of mitigating cybersecurity risks, but protecting your hardware and software is simply not enough. It’s essential to train your employees on a regular basis.

According to the 2014 U.S. State of Cybercrime Survey conducted by CSO, PwC, the U.S. Secret Service, and the CERT Division of Software Engineering Institute at Carnegie Mellon University, companies that fail to train new hires in cybersecurity reported annual losses of $683,000 compared to $182,000 for those who were trained.

At CWT, we regularly review and update our policies in response to changes in our business, technology, infrastructure and regulatory requirements. Our information security program includes training for all employees, not just new hires. We also celebrate an awareness week, during which we educate our staff on matters of cyber security-

Here’s what we do to reinforce our information security program:

- We Stay Current. We update our program to address new challenges and promote the program through training and awareness campaigns that run throughout the year. We don’t leave it stagnant on our intranet.

- We Think Globally. We work with our entire organization to ensure that everybody is aware of his or her role, no matter their position in the company.

- We Have a Clear Governance. Our Risk & Security Governance Committee focuses on global risk and security. Formed by our CEO, CTO and General Counsel among others, it has expanded by forming a sub-committee which focuses on the use of data.

- We Avoid Jargon. We make things easy to understand and don’t assume our audience is extremely tech-savvy.

- We’re Creative. We think of ideas to engage staff such as quests or small events. We make things fun so people will remember them.

To find out more about information security at CWT, feel free to read the Ethics and Business Behavior Chapter of our latest Annual Responsible Business Report – June 2018.

-

Pack it up, Pack it in – 7 steps to loading luggage like a pro

In the midst of the storm unleashed by Ryanair’s new luggage policy axing free carry-on luggage – and taking into account that business class tickets aren’t doled out as easily as in the past – here’s a few tips that will allow you to pack for success while sticking to your airlines’ baggage regulations.

1. Less Is More – They say an excellent rule of thumb is to travel with twice the amount of money you think you need and half the clothes. You don’t need a dozen pairs of shoes. Think carefully about what you will be wearing for each meeting and event. A good tip here is to pack a capsule wardrobe or similar color palette to create different outfits. And avoid the ‘what if’ mindset – even if you’re a proponent of Murphy’s Law. When it comes to shoes, invest in a pair that are both comfortable and sleek enough for a business do.

2. Don’t go crazy with the toiletries – You’re not a make-up artist. Maybe you are, in which case, skip this one. It’s likely that your hotel will provide almost everything you need. And remember the last time you had to relinquish your expensive moisturizer at security because you forgot you had it on you? Get samples of your favorite products or buy small travel containers to store them.

3. Carry your most important outfit as hand-luggage. If you’re going to a gala dinner to collect an award, or delivering a presentation worth millions, carry one outfit as hand luggage. That way, if they lose your luggage, you don’t have to contemplate representing your company in slippers.

4. Learn to fold Marie Kondo style. A little packing origami will allow you to pack more things in a single bag, saving you the hassle at check- in.

5. Wear your bulkier clothes on the plane – Not only will it give you extra room in your suitcase but you’re more likely to score the armrest from the person next to you, on account of being layered up like the Michelin Man – and therefore requiring more space.

6. Get your version of ‘la petite robe noire’. Next time you go shopping, buy versatile clothes that can be worn in an informal setting as well as more formal occasions by adding a few chic accessories. You can never go wrong with high-quality natural fabrics like linen, cashmere and silk, with minimalist silhouettes.

7. Buy the right suitcase. Go for a case that has maximum inside space and looks professional. You don’t want to walk into your client’s office carrying a neon trolley with a broken wheel. Plus, buy cheap, twice.

-

The Big Event – 9 routes to a killer SMM program

According to our latest figures, 54% of companies have benefited from Strategic Meetings Management (SMM) for several years now. But apart from being an acronym, you don’t want to get wrong – what is it exactly?

A management model that began in the mid-90s, SMM combines strategy, operations, and business intelligence to enable clients to manage their meetings and events program across their enterprise, resulting in a consistent attendee experience, measurable business objectives and consistent savings.

In fact, quantitative savings can range between 10 and 25% off the original spend before setting up the program.

And savings aren’t the only perk. An SMM program increases spend transparency, boosts negotiating power, helps you to mitigate risks and improve regulatory compliance.

There are a number of factors that influence the development of an SMM program. Internal factors, such as company goals, configuration and culture, play a crucial role in the structure of an SMM program, as do external factors, such as industry trends and geography of the company’s stakeholders and meetings.

What has resulted is a continuum of programs that range from fully mature global models to hybrid programs that encompass a few key components. Many companies perceive the lack of a unique model or standard as making the SMM model complex. In fact, the opposite is true. That there are so many potential configurations underscores the flexibility of SMM programs. Putting a program in place does not have to be an onerous or daunting task. Many of today’s most effective programs started small and grew, building on their successes.

If you have not joined the SMM legion yet, here are some tips that will allow you to create a killer program and benefit from its many perks:

- Focus on strategy first and tactics second. A sound and customized strategy is critical to achieving sustained success with SMM. The tactics of how to source, what services to outsource versus insource, who to partner with, how to process payments, technology choices, and policy issuance all need to stem from the central strategy.

- Don’t wait for perfect data or complete alignment. Start small, show value and grow from there. Many companies choose to start with big impact areas such as centralized venue sourcing.

- Stakeholders, stakeholders, stakeholders. Identify them early, get their buy-in and consider creating an internal committee with representatives from all impacted areas and regional road shows.

- Communicate your plan early to internal parties such as business owners and meeting planners, as well as external parties like hotel partners and technology providers. These are the people who will support your program. They must fully understand your roadmap and goals.

- Consider outsourcing components of your program to accelerate development and leverage external expertise. Professional meeting management companies can be a great consulting resource to get your program started.

- Don’t forget the small meetings. They represent 70 to 80% of all meeting expenditure, making them an important element of any program.

And if you have already started a program and are looking to expand it regionally or globally:

- Customize goals by region.

- Don’t be intimidated by the concept of going global; programs don’t have to be fully mature in all regions to show value.

- Consider pilot programs versus a full rollout to gain “mini-successes” and manage stakeholder expectations.

Get in touch with us if you want to learn more about SMM.

- Focus on strategy first and tactics second. A sound and customized strategy is critical to achieving sustained success with SMM. The tactics of how to source, what services to outsource versus insource, who to partner with, how to process payments, technology choices, and policy issuance all need to stem from the central strategy.